Tax season is officially underway, and January is one of the best times to find discounts on TurboTax products. Whether you’re a student, self-employed, or active-duty military, TurboTax offers several promotions to help make filing taxes more affordable and hassle-free. Below is a comprehensive look at the top TurboTax deals available this month, along with insights on how to take advantage of these savings.

1. Save an extra 10% on TurboTax Online Federal Products (for up to 50% off!)

One of the most popular discounts this month is the instant 10% off discount that applies to the current early season sale pricing on TurboTax 2025 online federal products. This offer, available until January 31, 2025, lets you choose from a range of service tiers that cater to different tax preparation needs (at up to 50% off!):

- Do-It-Yourself Versions: These options are perfect for individuals who feel confident filing their taxes independently using TurboTax’s intuitive software.

- Live Assisted Versions: If you’d like professional guidance along the way, these versions connect you with tax experts who provide real-time help.

- Full Service Versions: For those who prefer to avoid the hassle altogether, TurboTax’s experts can handle your entire tax filing process.

The flexibility of this deal allows you to select the level of assistance you need, making it a practical choice for a variety of taxpayers.

2. Get 50% Off QuickBooks Solopreneur Bundle (with Live Assisted Tax)

For freelancers, contractors, and small business owners, the QuickBooks Solopreneur bundle is an excellent choice. This ongoing promotion offers 50% off your first three months of service, reducing the price from $20/month to just $10/month.

This bundle combines the power of QuickBooks with TurboTax’s Live Assisted Tax feature, allowing solopreneurs to seamlessly transition from bookkeeping to filing taxes. TurboTax tax experts can access your QuickBooks financial data to provide tailored advice, ensuring accuracy and maximizing deductions specific to your industry.

Additional perks include:

- Unlimited Expert Support: Get live assistance from tax professionals whenever you have questions or need clarification.

- Guaranteed Accuracy: Your return is backed by TurboTax’s 100% Accurate, Expert-Approved Guarantee.

- Audit Support: If you’re audited, TurboTax provides one-on-one consultation with a trained tax expert.

This offer is available exclusively to new QuickBooks customers, making it a valuable option for those just starting with bookkeeping software.

3. Military Discount for Active-Duty Personnel

TurboTax offers an exceptional discount for active-duty military members and reservists ranked E1 through E9. Eligible individuals can file both their federal and state taxes for free using TurboTax Deluxe 2025, Premier 2025, or Self-Employed 2025 online products.

Here’s what you need to know about the military discount:

- Exclusions: The offer does not apply to TurboTax Live or Desktop products (CD/download versions).

- Eligibility: You must have a W-2 from the Defense Finance and Accounting Service (DFAS) to qualify.

For veterans and retirees, the standard TurboTax discounts, such as the 10% off federal products, are available. This promotion provides significant savings for those actively serving, eliminating the cost of filing altogether.

4. TurboTax for College Students

TurboTax also caters to college students, many of whom are filing taxes for the first time. The software offers a user-friendly step-by-step process to simplify the experience and ensure first-time filers don’t miss out on valuable education-related tax breaks.

Qualifying students can claim:

- Education Credits: Eligible filers may receive over $1,000 in education credits and deductions.

- International Student Support: TurboTax partners with Sprintax to assist non-resident students with their unique tax filing requirements.

For students, TurboTax serves as an excellent tool to navigate the complexities of tax season with ease, while potentially securing a significant refund.

5. TurboTax Free Edition for Simple Returns

For those with basic tax situations, TurboTax’s Free Edition allows you to file both federal and state taxes at no cost. This option is available to taxpayers with straightforward returns, such as Form 1040 filings, and limited credits like the Earned Income Tax Credit (EITC), Child Tax Credit, or Student Loan Interest Deduction.

It’s worth noting that only about 37% of taxpayers qualify for the Free Edition, as it does not support more complex situations involving business ownership, itemized deductions, or investments. However, for those who meet the criteria, it’s an unbeatable deal.

6. Bank and Credit Union Offers

TurboTax often collaborates with major financial institutions to provide exclusive discounts to their customers. Although details for 2025 are still emerging, partnerships with banks such as Bank of America, Citi, Wells Fargo, and Chase are expected to return this tax season.

Bank of America Cashback Offer

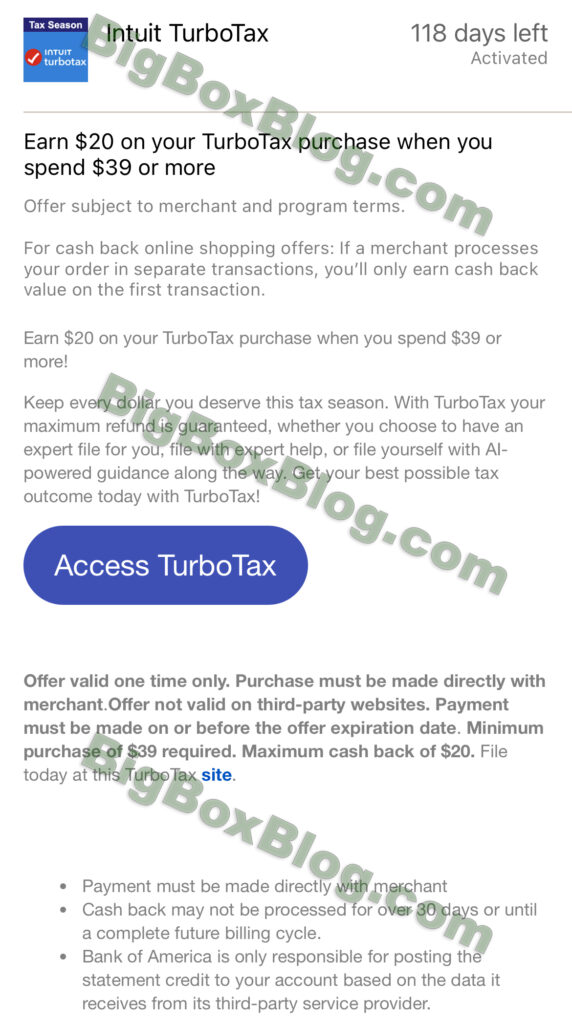

One recurring promotion is the $20 cashback offer for Bank of America customers. To qualify, you must:

- Activate the offer through your Bank of America account.

- Spend at least $39 on TurboTax products using a Bank of America credit or debit card.

- Receive a $20 cashback credit within 30 days or the next billing cycle.

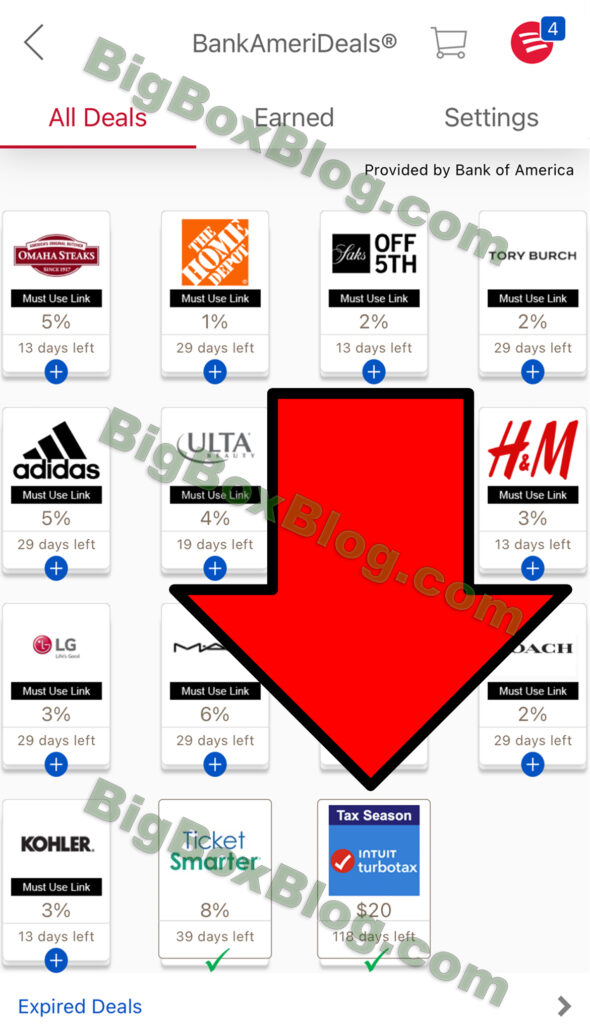

To check if the offer is available, log in to your Bank of America account and navigate to the “cash back deals” section (see examples below). While this deal isn’t as significant as other discounts, it’s an easy way to save a little extra.

Are These Bank Discounts Worth It?

In recent years, some users have noticed that these bank-affiliated discounts aren’t as compelling as they once were. This may be due to increased exposure of the offers on social media and forums, as well as the costs associated with these partnerships for TurboTax.

That said, it’s still worth exploring these promotions to see if they stack up against TurboTax’s direct offers.

Final Thoughts

January is an ideal time to lock in savings on TurboTax 2025 as you prepare to tackle tax season. With options ranging from free filing for simple returns to discounted Live Assisted versions and exclusive bundles for small business owners, TurboTax offers solutions tailored to a variety of needs.

For active-duty military personnel, the free federal and state filing option is an unbeatable benefit, while college students can take advantage of guidance designed for first-time filers. Meanwhile, partnerships with banks like Bank of America add additional opportunities for savings, even if they’re not as robust as they once were.

Remember, many of these deals are available for a limited time, with several ending by January 31, 2025. Be sure to check TurboTax’s website or your financial institution’s offers page for the latest updates as the April 15 tax deadline approaches.

With these discounts in mind, you’re well-equipped to save money while filing your taxes confidently this year.