January is almost here, which means it’s time to start thinking about filing your taxes. Fortunately, TurboTax is offering some excellent discounts to help ease the financial burden. Whether you’re filing a simple return or need support for a more complex tax situation, there are deals to suit your needs. Additionally, if you’re a Capital One customer, there are ways to leverage rewards through their ecosystem, even though they don’t offer direct TurboTax discounts. Let’s break down the top TurboTax offers available in January 2025 and explore how Capital One customers can make the most of these opportunities.

Extra 10% Off TurboTax Online Federal Products (For Up to 50% Off Total Savings!)

One of the best deals available this month is TurboTax’s extra 10% off discount on its federal online products. This discount stacks on top of their early-season promotions, allowing for total savings of up to 50% off. The discount applies across all service tiers, so you can select the option that fits your needs:

- Do-It-Yourself Versions: These are designed for individuals who feel confident managing their own tax filings. TurboTax’s user-friendly interface makes it simple to navigate through tax forms and find the deductions you qualify for.

- Live Assisted Versions: Ideal if you want professional guidance. This option provides access to tax experts who can answer your questions and help ensure your return is accurate.

- Full-Service Versions: If you prefer a hands-off approach, this version allows a tax professional to handle the entire filing process for you.

This promotion is available through January 31, 2025, so there’s plenty of time to take advantage of the deal and get a head start on filing your taxes.

50% Off QuickBooks Solopreneur Plan (With Live Assisted Tax)

For freelancers, contractors, and small business owners, TurboTax’s partnership with QuickBooks offers a standout deal. New QuickBooks customers can save 50% off the first three months of the QuickBooks Solopreneur plan, reducing the cost from $20 per month to just $10 per month. This subscription includes access to QuickBooks Live Assisted Tax, which is tailored to self-employed individuals filing a Schedule C (Form 1040).

The Solopreneur plan is particularly useful for anyone juggling bookkeeping and tax preparation. Here are the key benefits:

- Unlimited Access to Tax Experts: Get help maximizing deductions and ensuring your return is accurate.

- Seamless Integration with QuickBooks: TurboTax experts can access your QuickBooks data, making tax preparation faster and more precise.

- Industry-Specific Advice: Experts can help you uncover credits and deductions unique to your line of work.

- 100% Accurate, Expert-Approved Guarantee: TurboTax stands behind its accuracy promise.

- On-Demand Audit Support: You’ll have access to one-on-one guidance in the event of an audit.

This deal is only available to new QuickBooks customers, so it’s worth exploring if you’ve been considering streamlining your financial management tools.

TurboTax Free Edition

For taxpayers with a simple return, the TurboTax’s Free Edition offers an entirely cost-free way to file federal and state taxes. However, not everyone qualifies for this option. A simple return includes:

- Filing a basic Form 1040.

- Claiming limited credits like the Earned Income Tax Credit, Child Tax Credit, or Student Loan Interest Deduction.

- Avoiding additional schedules or complexities, such as business income or substantial investments.

While TurboTax estimates that about 37% of taxpayers qualify for the Free Edition, anyone with more intricate tax needs will need to opt for a paid plan. It’s an excellent option for students, part-time employees, or retirees with straightforward tax situations.

What About Capital One? Do They Offer TurboTax Discounts?

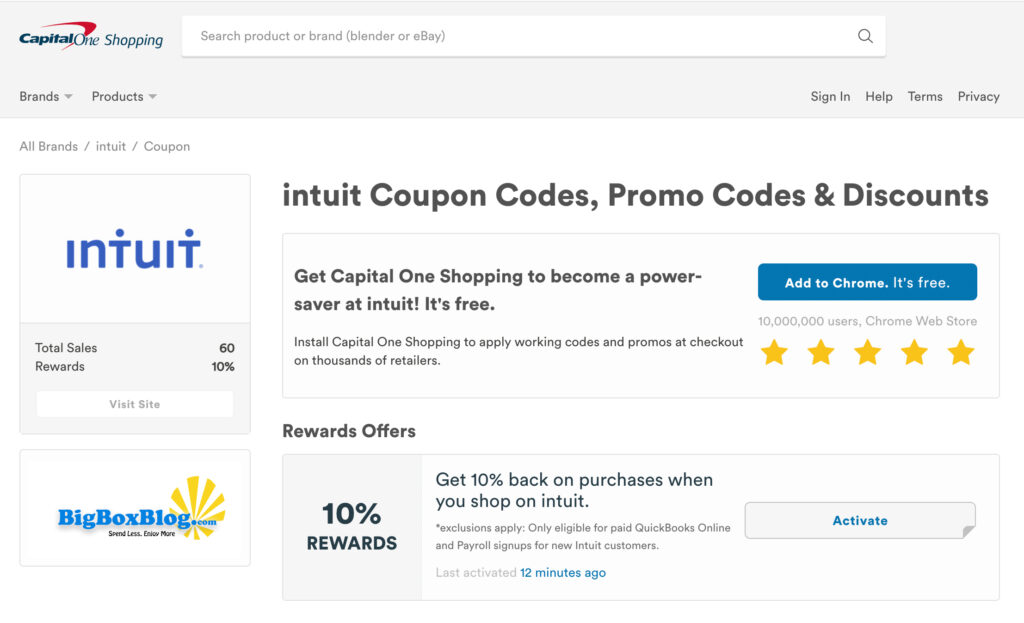

If you’re a Capital One customer, you might wonder if the bank offers any exclusive TurboTax discounts. Capital One is the 6th largest bank in the United States and provides a range of perks through its Capital One Shopping platform. Unfortunately, while there are hundreds of deals on travel, retail, and software through Capital One Shopping, there’s currently no direct TurboTax discount offered through Capital One.

Leveraging Capital One Rewards for TurboTax

While Capital One doesn’t offer a TurboTax-specific discount, you can still get 10% back in rewards if you purchase TurboTax through your Capital One account. Here’s how it works:

- Sign Up for Capital One Shopping: If you haven’t already, you can create a free account on the Capital One Shopping platform.

- Search for TurboTax: Navigate to the TurboTax page within Capital One Shopping.

- Earn Rewards: When you purchase TurboTax using your Capital One credit card, you’ll earn 10% back in rewards.

While 10% back in rewards isn’t the most generous offer available for TurboTax, it’s still a nice bonus if you’re already planning to use the software and are a loyal Capital One customer.

Why Doesn’t Capital One Offer a TurboTax Discount?

It’s a fair question, given how competitive the marketplace is for financial institutions to provide perks. Banks like Chase, Schwab, and Robinhood often offer TurboTax discounts to their customers. Additionally, groups like AAA or members of the military may also qualify for exclusive TurboTax deals.

The lack of a TurboTax discount from Capital One is a bit surprising, especially since they’re known for their catchy “What’s in your wallet?” slogan. While the 10% back in rewards is a nice perk, it doesn’t quite stack up to some of the deeper discounts available elsewhere.

Other Ways to Save on TurboTax

If you’re looking for a better deal, here are a few alternatives to consider:

- AAA Members: AAA often partners with TurboTax to provide discounts on federal and state filing services.

- Military Discounts: Active-duty military members and veterans can usually access TurboTax discounts during tax season.

- Other Banks: Check if your bank offers TurboTax discounts. For example, Chase and Schwab have been known to provide such perks.

- Coupon Sites: Many coupon and deal aggregator websites feature promo codes for TurboTax, often offering similar or better discounts than what Capital One rewards provide.

Final Thoughts

TurboTax’s January 2025 discounts make it an excellent time to get a head start on your taxes. Whether you’re taking advantage of the extra 10% off federal online products, exploring the QuickBooks Solopreneur plan, or qualifying for the Free Edition, there’s something for nearly every type of filer.

As for Capital One customers, while there’s no direct TurboTax discount, the ability to earn 10% back in rewards through Capital One Shopping is still a worthwhile option if you’re already a cardholder. However, it’s worth exploring other avenues to ensure you’re getting the best deal possible.

At the end of the day, the key is to start early, evaluate your options, and choose the tax preparation solution that best fits your needs. By taking advantage of these January deals, you can save both time and money—and make tax season just a little less stressful.