Tax season always comes with the inevitable question: How should I file my taxes this year? For many people, the debate boils down to two popular options: TurboTax LIVE or hiring a Certified Public Accountant (CPA). I’ve used both options in the past, and each has its strengths and weaknesses. In this article, I’ll break down the benefits of each, compare costs, and share insights to help you make an informed decision. As required by law, I’ll also remind you that this is not financial advice—consult a tax professional or trusted advisor for guidance specific to your situation.

Let’s also not forget TurboTax’s current promotion: an extra 10% off their federal online products, stacking on top of their early-season sale for a total savings of up to 50% off. This deal is valid through January 31, 2025, and applies to all TurboTax service tiers, which I’ll explain in more detail below.

The Benefits of Using a CPA

CPAs have long been the gold standard for tax preparation. They’re licensed professionals with specialized expertise, making them particularly valuable for individuals or businesses with complex tax situations. While TurboTax has significantly closed the gap by introducing features like LIVE Assisted and Full-Service options, there are still a few reasons why someone might opt for a CPA:

- Saves Time: If you dread the thought of sifting through tax forms and entering data, a CPA can save you considerable time by handling the process for you. They’ll often ask for your documents and take care of the rest.

- Familiarity with Your Situation: Working with the same CPA over time fosters a personal relationship. This can be especially beneficial if your taxes involve unique complexities, like multiple income streams, extensive deductions, or estate planning.

- In-Person Experience: For some, the face-to-face interaction with a CPA provides peace of mind. If you prefer discussing your financial matters in person, a CPA might feel like the right choice.

That said, the need for in-person meetings has diminished thanks to the rise of tax software and virtual consultations. For straightforward tax situations or even moderately complex ones, the advantages of using a CPA may no longer justify the higher cost.

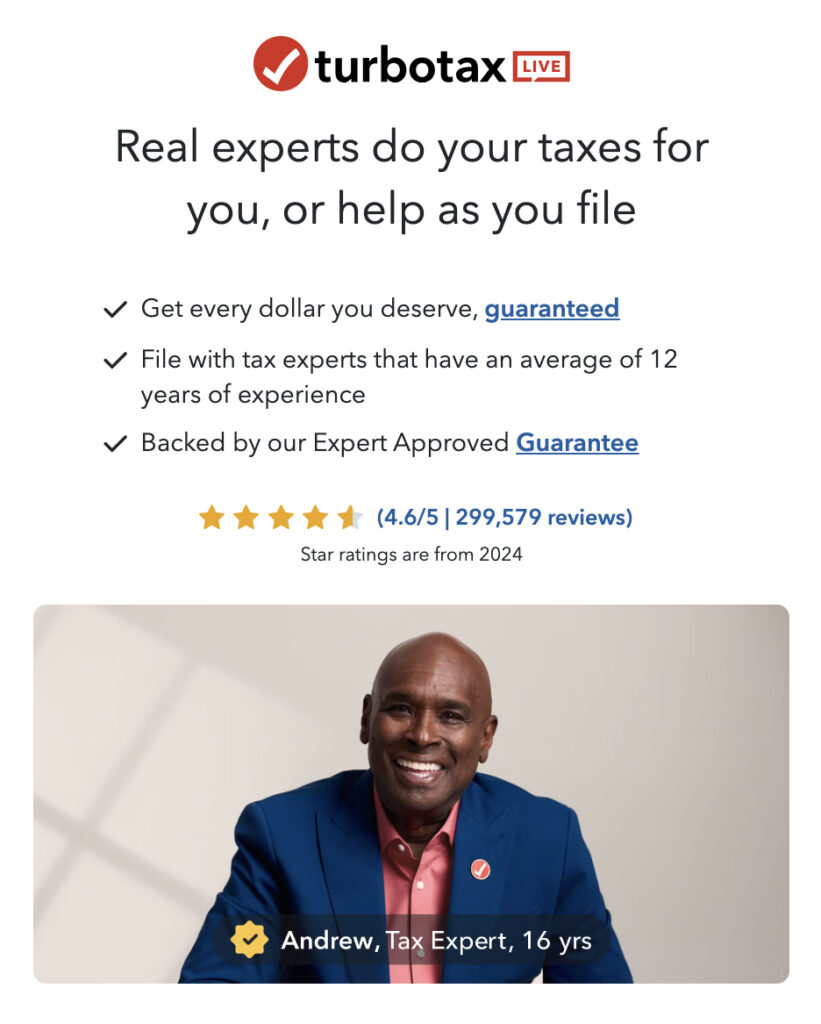

Benefits of TurboTax LIVE

When TurboTax introduced its LIVE Assisted feature, it fundamentally changed the game for people like me who wanted professional guidance without the expense of a CPA. Here are some of the key benefits of using TurboTax LIVE:

1. Cost Savings

The most obvious advantage is the price. For example, TurboTax LIVE Premium—a popular choice for self-employed individuals or those with investments—costs about $200 less than the average CPA fee for filing an itemized 1040 with a Schedule A. TurboTax’s costs vary depending on the level of service you choose, but they’re almost always significantly cheaper than hiring a CPA.

2. Convenience

TurboTax LIVE allows you to work at your own pace. Unlike a CPA, who might require you to meet during business hours, TurboTax is available 24/7. This flexibility is invaluable if you’re busy or need time to locate specific documents.

3. File from Home

One of my favorite features of TurboTax LIVE is the ability to file from home. You don’t have to worry about scheduling an appointment or driving to an office. You can even share your screen with a TurboTax expert if you’re using their LIVE Assisted service, making it easy to get help without leaving your couch.

4. Stress-Free Guidance

I’ve always found tax season stressful, but TurboTax LIVE’s experts feel more like GPS guides than taskmasters. They’re calm, professional, and always available to answer questions—even in April, when CPAs are often overwhelmed with other clients.

5. Accuracy Guarantee

TurboTax offers a 100% accuracy guarantee for their calculations, giving you peace of mind. While I’m sure my CPA did accurate work, it’s comforting to know that TurboTax will cover any penalties or interest if there’s a calculation error on their end.

6. Audit Representation

With a Max upgrade (under $70), TurboTax offers full audit representation and identity theft protection. While CPAs can provide audit support, it’s often billed at a steep hourly rate, which can add up quickly.

7. Saves Data for Next Year

TurboTax saves your information for the following year, streamlining the process. The first time I used it, it took a bit longer to input all my details, but the second year was much faster.

Can TurboTax Replace a CPA?

The short answer: It depends on your situation.

For Simple to Moderate Returns:

TurboTax LIVE is a great option. It combines the ease of DIY software with the added benefit of live expert assistance, making it a cost-effective choice for individuals, families, and small business owners with straightforward taxes.

For Complex Returns:

If your taxes involve intricate matters like international income, complicated business structures, or trust accounting, a CPA might still be the better choice. While TurboTax LIVE experts are highly trained, they may not offer the same level of personalized service as a CPA who has worked with you for years.

TurboTax vs. CPA Cost Comparison

Cost is often the deciding factor for many taxpayers. Here’s a breakdown of the average costs:

- CPA Fees: According to the National Society of Accountants, the average cost to file an itemized 1040 with a Schedule A is $323. For more complex returns, the cost can climb to $500 or more.

- TurboTax Costs:

- Free Edition: For simple returns (Form 1040 only).

- Deluxe: Starts at $59.

- Premier: Starts at $89 (ideal for investments and rental properties).

- Self-Employed: Starts at $119 (great for freelancers and small business owners).

- LIVE Assisted versions of these plans typically add $80 to $120.

Both TurboTax and CPAs charge additional fees for filing state returns (about $50).

In my experience, switching from a CPA to TurboTax LIVE saved me about $200. While the upfront time investment was slightly higher, the overall savings made it worth it.

TurboTax LIVE vs. CPA: Head-to-Head Comparison

| Feature | TurboTax LIVE | CPA |

|---|---|---|

| Cost | Lower (e.g., $200 for LIVE Premium) | Higher (average $323+) |

| Convenience | File anytime from home | Requires scheduling and travel |

| Expert Assistance | Available with LIVE or Full-Service | Personalized, face-to-face guidance |

| Accuracy Guarantee | 100% accuracy guarantee | Varies by CPA |

| Audit Representation | Included with Max upgrade (<$70) | Often billed hourly |

| Time Savings | May take more time upfront | Saves time for complex returns |

| Personalization | Moderate (LIVE experts) | High, especially for long-term clients |

Switching from a CPA to TurboTax: What You’ll Need

If you’re considering making the switch, here’s what you’ll need:

- Last Year’s Tax Return: This helps TurboTax pre-fill some fields and ensures accuracy.

- Login Information for Financial Accounts: Many institutions allow you to directly import tax forms (e.g., 1099s).

- Dependent Information: Birthdates and Social Security numbers for family members.

- Other Tax Documents: W-2s, 1099s, retirement contributions, business expenses, and any other records you’d normally give to your CPA.

The transition was smoother than I expected. I didn’t need to involve my CPA at all—everything was in my hands.